Lease Expiration Management for Residential Real-Estate

- michaelwoolfson

- Sep 30, 2022

- 5 min read

Introduction

As discussed in our past blogs, revenue management is defined as

“the practice of predicting or anticipating customer behavior and then optimizing pricing, product availability, and distribution, to maximize the amount of revenue you bring in. The practice relies heavily on the collection of data and the use of analytics to identify patterns and forecast levels of demand”.

This process has been implemented successfully across several industries, being a key factor in the success of hotels, ridesharing apps like Uber and Lyft, and airline companies. In more recent years, the practice of revenue management has been incorporated into the residential real estate space, helping owners and property managers better price their rental units to increase rent revenue and decrease vacancy costs. However, there are a few differences between the revenue management done in these other industries and for the rental industry, including lease expiration management.

WHAT IS LEASE EXPIRATION MANAGEMENT?

Our revenue management system for residential rentals works by ingesting data to determine optimal rent prices. More specifically, it determines a base price by collecting static data which includes factors such as square footage, features, finishes, views, amenities, etc. After this base price is determined, dynamic data such as vacancy rates, availability rates, days till a unit becomes vacant, demand, seasonality, competitor/market prices, and more are used to dynamically adjust the base price – determining a final recommended price for a rental unit. Essentially, the system is taking all these factors into account and running simultaneous experiments to determine what the highest rent price can be without increasing vacancy (intuitively, the higher the rent, the fewer leases will be signed) – finding the optimal balance between these two variables. This process works terrific for 12-month leases as it optimizes your rent revenue, decreases your vacancy, and levels out move ins/move outs by changing pricing based on your supply and demand.

However, having 12-month leases with tenants moving out exactly at the end of their lease-term end date is not realistic in today’s environment. Tenants expect greater flexibility, and owners and property managers are increasingly offering different lease terms such as 6-month, 9-month, 12-month, and 15-month leases. This adds another layer of complexity and consideration to the problem of optimizing your rental rates, which is where lease expiration management comes into play.

Lease Expiration Management is the process of controlling the number of lease expirations at each future point of time through dynamically pricing your product. Essentially, this portion of revenue management takes another factor (beyond the ones I described above) into account to change the monthly rent price: lease-term.

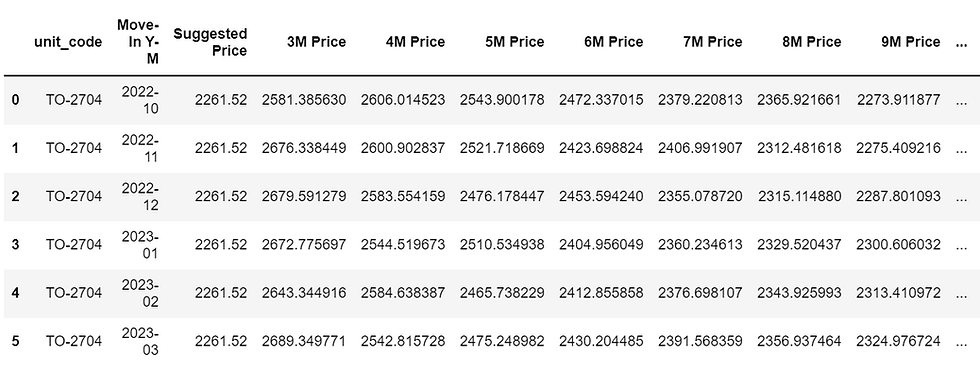

Let’s look at a few apartment units as an example. For all these units, we utilize the methods discussed above to determine the recommended price for a 12-month lease. However, this tenant is debating between a few different lease terms. So, using our lease-expiration algorithm, we can offer the tenant different monthly rental prices depending on the different lease terms as demonstrated below:

WHY CARE ABOUT LEASE EXPIRATION MANAGEMENT?

Admittingly, lease expiration management is only one of the many key processes within revenue management. If your organization is yet to adopt revenue management, then that is most likely the first step you want to take before looking at incorporating lease expiration management. However, if your organization is already utilizing revenue management, the importance of lease expiration as part of that process cannot be understated.

For one, lease expiration management will help your overall revenue management perform better – increasing your rent revenue and decreasing your vacancy costs. It levels out your supply and demand, and allows you to offer different lease terms, giving tenants more options and flexibility. This will most likely lead to more interested tenants and increase demand for your units. If you are already offering different lease terms without using these tools, you are most likely hurting your organization’s revenue. Finally, lease expiration management also helps your operations team. As you are leveling out the move-in and move-outs and planning for future turnover, your operation team should be able to handle turnover scenarios much easier – further decreasing the time units are vacant due to the classic turnover challenges or needed repairs/renovations.

HOW LEASE EXPIRATION WORKS

For our Lease expiration model there are generally three factors that affect the price.

Contract Length: Again, our goal with revenue management is to improve your bottom line by finding the optimal point between rent revenue and vacancy. Intuitively, the longer the lease term the less vacancy you will face, meaning you incentivize longer lease terms by dropping the rent price. Conversely, the shorter the lease the higher risk of vacancy, so the higher the rent price. Thus, you are incentivizing tenants to lease for longer. Beyond the risk of vacancy, the cost of turnover (cleaning, repairs, renovations) increases the shorter the lease terms, further impacting the rent we are willing to do for different lease terms.

Number of Contract Expiries: This factor considers the number of contracts ending at certain times. When discussing why you should do lease expiration management, one of the major factors is to level out the move-in/out dates to help your organization operationally, as well as level off revenue and demand throughout the year. Therefore, we want to incentivize tenants to take lease terms that benefit your internal lease schedule. For example, if it is September 2022, and you have a high number of move-outs in September 2023 but very few in June 2023 or December 2023, you would want to incentivize the tenant to take a 9-month or 15-month lease through lower rent prices to level off this move in and outs.

Vacancy Capture Rate (or hold-out date): This factor has to do with how long it takes a tenant to move in. If a person moves in earlier, then we will lose less on vacancy, and vice versa. Therefore, we want to incentivize people to move in as early as possible. For example, if one month of rent is $1000 and a tenant moves in one month after a unit is available then you will lose out on $1000 of rent revenue. Therefore, we use this module to attempt to capture a certain amount of these vacancy costs. If we attempt to capture 20% of this vacancy cost, or $200 in this example, then we will want to add $200 to this person’s rent (or $16.67 per month for a 12-month lease by doing $200/12 months = $16.67).

CONCLUSION

In conclusion, the practice of lease expiration management is a very critical part of revenue management. Although it is more advanced, you should be quite proficient in revenue management first to be able to handle different lease terms from an operational perspective if your organization is ready there are many benefits of engaging in the practice. This new, innovative way to think about pricing can greatly increase your bottom line by increasing rent revenue, decreasing vacancy costs, helping your operations team, and helping your organization be more attractive to prospective tenants by offering more flexible terms. If you are interested in learning more or getting started with lease expiration management, reach out to our team of experts today.

**Please note, this discussion is less relevant for properties in rent controlled areas…

Kommentare